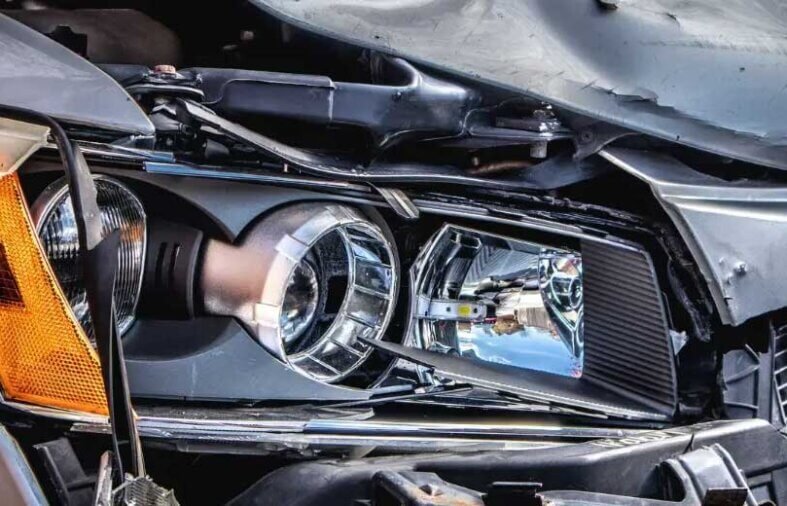

When you’re involved in a car accident and you’re not at fault, the process of getting your vehicle repaired can still be a bit tricky. One of the biggest questions people have after a non-fault accident is, “Who covers the cost of repairs?” The good news is that you usually won’t have to pay for repairs out of your own pocket, but navigating the insurance process can sometimes be a little confusing. Let’s go through who typically covers the cost and what steps you should take to ensure your car is properly repaired without breaking the bank.

How Insurance Works in Non-Fault Car Accidents

In most cases, the at-fault driver’s insurance should cover the cost of repairs to your car. That’s one of the reasons why having the other driver’s insurance details is so crucial after an accident. If the other driver is insured, their insurance company will typically pay for the repairs to your car, either directly or through your own insurer. In a non-fault situation, this means you won’t have to worry about paying out of pocket for repairs. However, there are times when the at-fault driver might not have insurance, which can complicate things. Check out this link for repair options for non-fault accidents.

The Role of Your Own Insurance Company

What happens if the at-fault driver is uncooperative, or perhaps even uninsured? In this case, your own insurance may step in to cover the cost of repairs, provided you have the relevant coverage in place (such as comprehensive insurance or uninsured motorist cover). Your insurer will pay for repairs upfront and may later attempt to recover the costs from the at-fault driver’s insurance company through a process known as subrogation. It’s worth noting that making a claim through your own insurance may affect your premiums, even if you weren’t at fault.

What Happens If the At-Fault Driver Cannot Be Identified?

In the unfortunate event of a hit-and-run accident, where the at-fault driver cannot be identified, things can get tricky. If you’re unable to track down the other driver, your insurance company may be your first line of defence. Depending on your policy, you may be able to make a claim through your own insurer, using either your own comprehensive coverage or the uninsured motorist coverage. This is a vital reason why it’s always a good idea to have a dash cam or other evidence that could assist with identifying the culprit.

Choosing Your Repair Shop

Once the insurance claim is sorted, you’ll need to figure out where to get your car repaired. Some insurers have a network of approved repair shops that you must use. These repair shops are generally trusted by your insurer and may provide quicker service. However, you may be able to choose your own repair shop, depending on your policy. It’s worth checking with your insurer before you proceed. If you have a preferred repair shop in mind, be sure to confirm whether it’s within the insurer’s approved network to avoid any complications later on.

Rental Car Coverage While Your Car is Being Repaired

If your car is out of action for repairs, many people rely on rental car coverage to get around. When you’re not at fault in an accident, you may be entitled to a rental car while yours is being fixed. This coverage is often provided by the at-fault driver’s insurance company. However, if the at-fault driver is uninsured or underinsured, your own insurance may cover the cost of a rental car instead. Always check the terms of your insurance policy to ensure you’re covered during this time.

How to Ensure a Smooth Repair Process

To ensure the repair process goes smoothly, make sure to keep a record of all communication with your insurance company, repair shops, and the other driver (if possible). Take photos of the damage to your car right after the accident, and always get a repair quote before agreeing to any work. It’s also wise to double-check that the repair shop has experience working with insurance claims, as this can help speed things up. The more documentation you have, the smoother the process will be.

Conclusion

While being in a non-fault accident can be stressful, understanding who is responsible for the repair costs and how the process works can help ease the burden. By knowing your rights, understanding how insurance works, and keeping detailed records, you’ll be in a strong position to ensure your vehicle is repaired without unnecessary complications. So, next time you’re involved in a non-fault accident, you’ll know exactly what steps to take to protect yourself and your car.